Executive Summary

- The S&P 500 fell 1.6% last week to close at 6,728.8

- There was a widespread sell-off in the Tech space

- The Nasdaq Composite had its worst week since the week ending April 4th

- The jobs market is a concern for the Federal Reserve

- Data is scarce, but the jobs market seems steady

- U.S. services sector economic activity picked up in October

- A diversified portfolio is more important for risk management than ever

The S&P 500 fell 1.6% last week to close at 6,728.8. The Nasdaq 100 fell 3.1% on the week. The declines were blamed on a report released Thursday by Challenger, Gray & Christmas, according to Barron’s. But the market fell throughout the week. The Challenger Gray report wasn't released until Thursday. The report may have helped sink the market last week, but it wasn't the lone catalyst.

Selling in the Tech space was widespread. MSFT fell 4%. Tesla fell 5.3%. Broadcom slid 7.3%. Nvidia and Oracle fell 8.9% and 10% respectively.

The Nasdaq and the S&P 500 both tested their 50-day moving averages on Friday and held.

S&P 500 Chart

The Nasdaq Composite had its worst week since the week ending April 4th. The S&P had its worst week since the week ending 10 October, according to Barron’s. The S&P has fallen 289 points or 4.2% peak to trough since it hit a high of 6,920.34 on 29 October. A correction may have begun. The 50-day moving average is support. A break below the 50-day would open the door for a fall to 6,550.78, which is next support. A decline to 6,550.78 would be 5.3% below the 29 October high, only halfway to a correction.

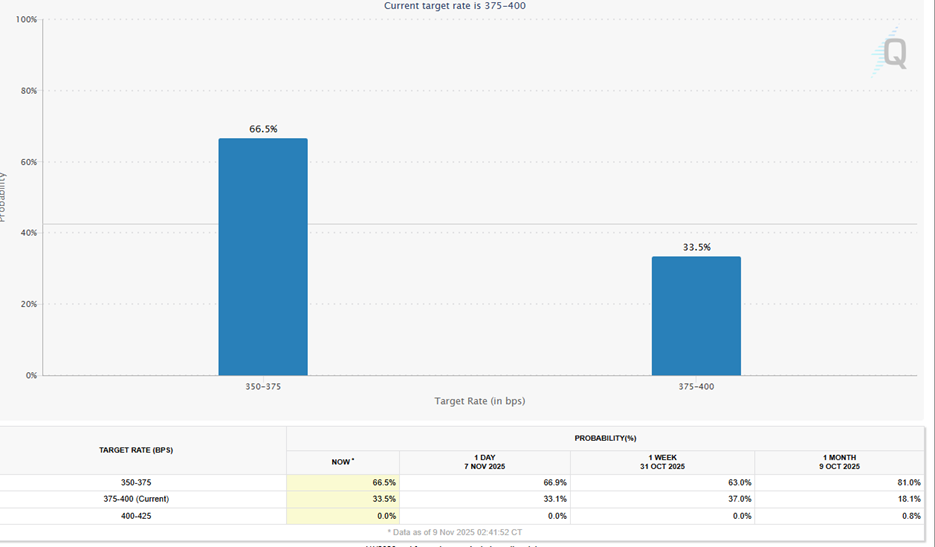

The jobs market is a concern for the Federal Reserve. Whether the data justifies another cut this year is questionable. Investors are hoping for a cut. Fed Chairman Powell might not give it to them. He was hawkish during the post-meeting press conference a few weeks ago. The CME FedWatch tool has the odds of a quarter-point cut in December at 66.9%. That’s up from 63.0% last week. It’s down from 79.2% on 8 October.

It was the jobs market that triggered selling last week, according to pundits. The Challenger Gray report had this to say about jobs:

U.S.-based employers announced 153,074 job cuts in October, up 175% from the 55,597 cuts announced in October 2024. It is up 183% from the 54,064 job cuts announced one month prior. “October’s pace of job cutting was much higher than average for the month. Some industries are correcting after the hiring boom of the pandemic, but this comes as AI adoption, softening consumer and corporate spending, and rising costs drive belt-tightening and hiring freezes. Those laid off now are finding it harder to quickly secure new roles, which could further loosen the labor market,” said Andy Challenger, workplace expert and chief revenue officer for Challenger, Gray & Christmas. Through October, employers have announced 1,099,500 job cuts, an increase of 65% from the 664,839 announced in the first ten months of last year. Year-to-date job cuts are at the highest level since 2020, when 2,304,755 cuts were announced through October.

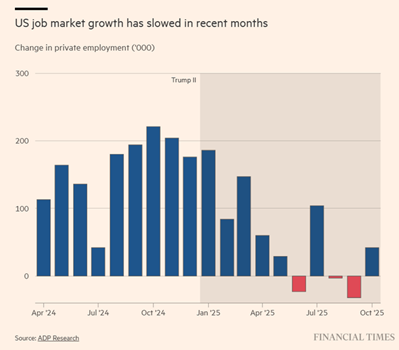

But the employment picture is far from clear-cut, as is the state of the economy. ADP released its payroll report on Wednesday. Hiring at U.S. companies rebounded in October. Private sector employment increased by 42,000, according to ADP. “Private employers added jobs in October for the first time since July, but hiring was modest relative to what we reported earlier this year,” said Dr. Nela Richardson, chief economist, ADP. Still, 42,000 private jobs in October beat the 29,000 decline in private jobs in September. A hiring recovery last month is “not surprising,” Apollo chief economist Torsten Sløk said about the report. Slok believes the labor market is weakening, but not due to a slowing economy. Instead, he points to a reduced labor supply as putting downward pressure on job growth. He believes there are fewer people looking for jobs because of reduced immigration.

ADP tracks private jobs, not overall payrolls. Revelio Labs is another private data tracker. It estimates that overall payrolls dipped by 9,100 in the latest month, according to Barron's. The decline was due to a 22,200 decline in government employment. Yet the Bank of America Institute didn’t find a slowdown in employment. The bank based its conclusion on an analysis of internal deposit flows. BofA believes payrolls were up 0.5% from a year earlier, the same as in September. Meanwhile, BCA wrote in a note to clients that initial jobless claims remain low. BCA based its conclusion on data from the states.

The Chicago Fed estimated that last month’s unemployment rate was 4.36%. That is almost unchanged from its September estimate of 4.35%. The BLS put the August jobless rate at 4.3%. A reasonable conclusion is that unemployment did not rise in October. All in all, it seems as if the jobs market is steady, if no longer booming.

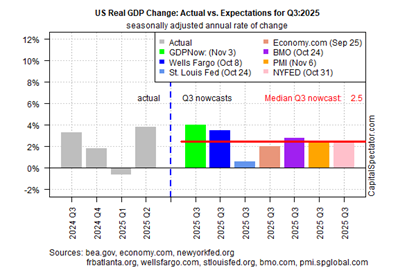

The economy seems to be doing fine as well, although there is a paucity of data to analyze. The Atlanta Fed’s GDPNow tool is estimating Q3 GDP growth of 4.0%. The St Louis Fed’s GDPNow tool is estimating Q3 GDP growth of 0.6%. The median Q3 Nowcast stands at 2.5% (chart below).

The economy has slowed from 3.8% in Q2, assuming the 2.5% growth rate estimate holds. Yet it is still growing above trend. And there is still job growth in the private jobs market.

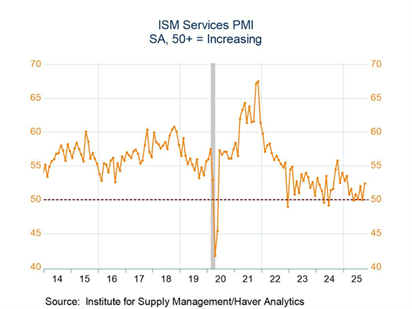

There are other signs of life in the economy as well. U.S. services sector economic activity picked up in October. It rose at its strongest rate since February. (chart below)

The rebounds in both the Business Activity and New Orders indices in October are positive signs, according to Steve Miller, Chair of the ISM Services Business Survey Committee.

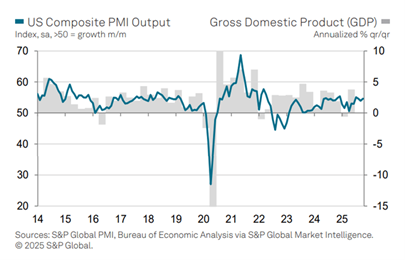

The S&P Global US Composite PMI also showed a pick-up in economic activity in October.

Based on the Composite PMI index, the economy expanded at a moderate pace. Growth came from firmer activity in the manufacturing and service sectors, reported S&P Global.

To Summarize:

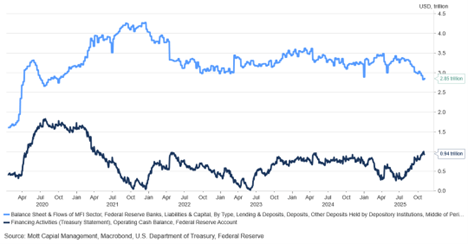

The economy is still growing above trend (the Fed estimates that 1.8% is the trend growth rate for the U.S. economy). The private sector jobs number is still positive, with unemployment remaining low. Inflation is no longer falling. The Fed may not cut in December after all. And the stock market may be in the early stages of a correction. A lack of liquidity may be partly to blame for that last, according to Michael Kramer of Mott Capital. The Treasury General Account (TGA) continues to rise. Fed reserves continue to fall.

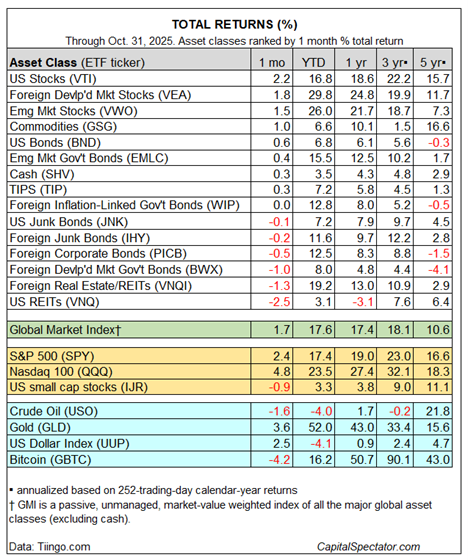

A diversified portfolio is more important for risk management than ever. Diversification means owning other assets besides the concentrated S&P 500. Yes, the U.S. stock market has done well so far in 2025. But it hasn’t been the best performer. Foreign Developed and Emerging Markets have outperformed year-to-date. So has foreign real estate, for that matter. (see chart below).

It could be an interesting last six weeks of the year. And a diversified portfolio will help you weather the next correction/bear market. Diversification is still the only free lunch in investing after all.

(None of this newsletter is intended as specific or appropriate investment advice. Consult a financial planner or advisor for advice that may be appropriate for your situation.)

Regards,

Christopher R Norwood, CFA

Chief Market Strategist