Executive Summary

- The S&P 500 rose 1.9% last week

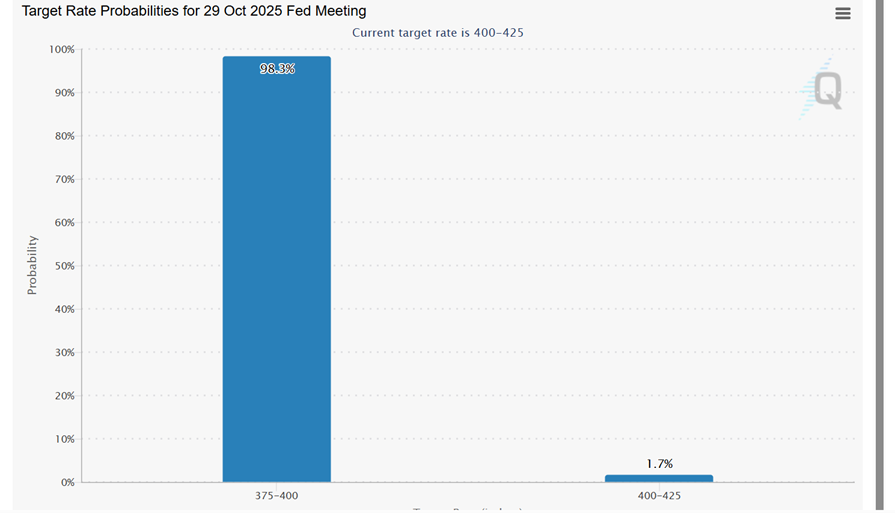

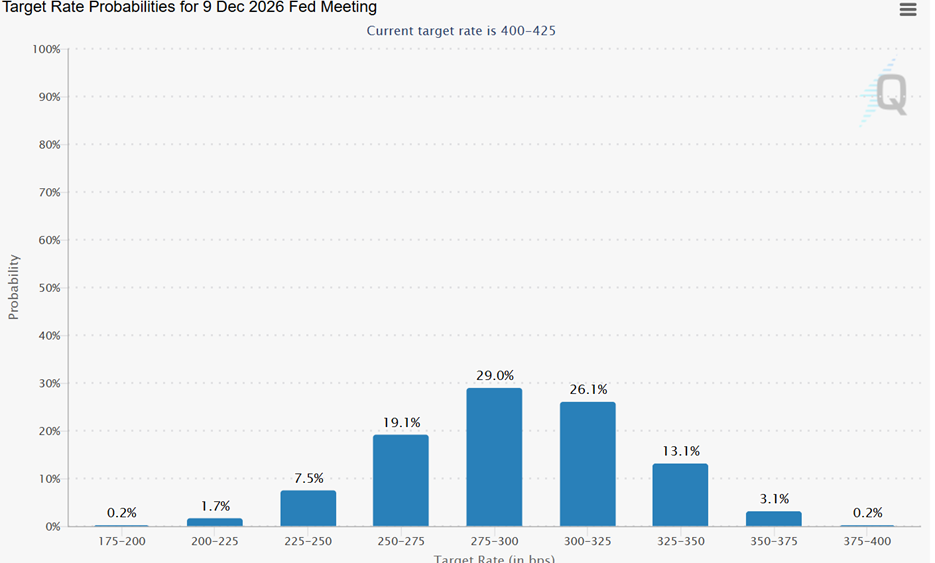

- The Fed will cut the Fed funds rate by 0.25% this week. The funds rate is currently 4.00% to 4.25%.

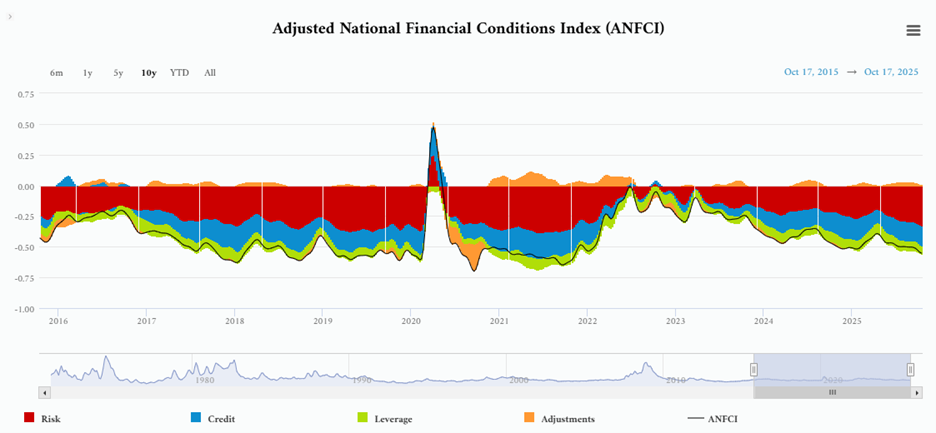

- Financial conditions are already easy

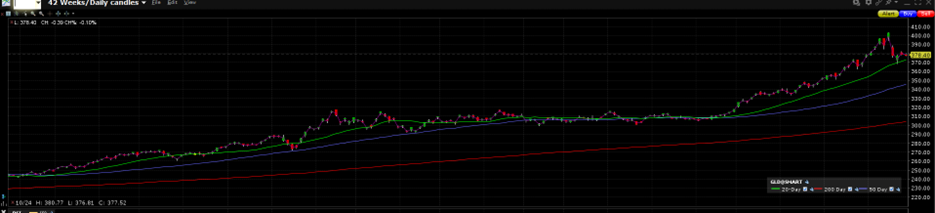

- The stock market is setting new highs

- Gold typically does best when liquidity is abundant

- Gold is up 54% YTD

- Bond investors seem to be signaling a recession ahead

- Stock investors see blue skies instead

The Stock Market

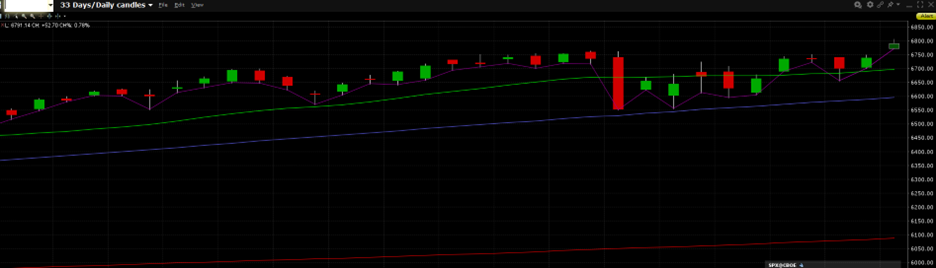

S&P 500 5-Day Chart

The S&P 500 rose 1.9% last week. It broke out on Friday. The index had been consolidating for nine days within the range set the previous Friday.

S&P 500 index

The Nasdaq 100 rose around 2.2% for the week, and the Dow Jones around 2.2%.

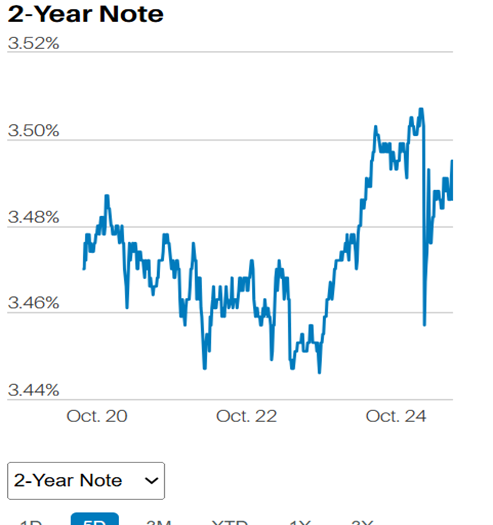

The 2-Year Treasury yield rose a few basis points (1/100th of a percent).

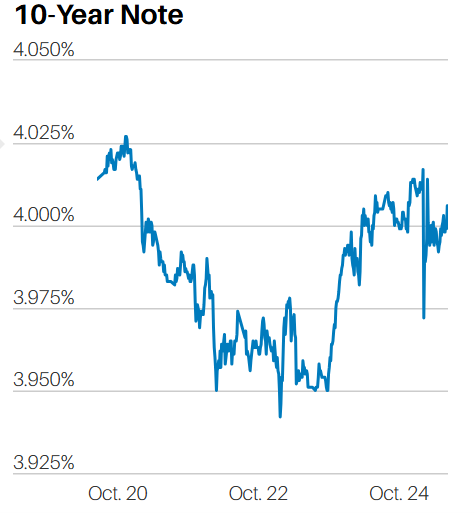

The 10-Year Treasury yield fell one basis point.

The Fed will cut the Fed funds rate by 0.25% this week. The CME FedWatch tool odds are at 98.3%. The funds rate is currently 4.00% to 4.25%.

Bond investors think the Fed will cut in December and two to three more times in 2026. (see below)

The aggressive rate cut schedule predicted by the futures market is unlikely to materialize without a recession. Yet the Atlanta Fed’s GDPNow tool is estimating 3.9% growth in Q3. The Atlanta Fed’s GDPNow tool tends to be accurate within 30 days of the report date. Q3 GDP will be released on October 30th, maybe. The government shutdown may delay the release.

And financial conditions are already easy, even before a Fed rate cut. A negative number means looser than normal financial conditions. (see below)

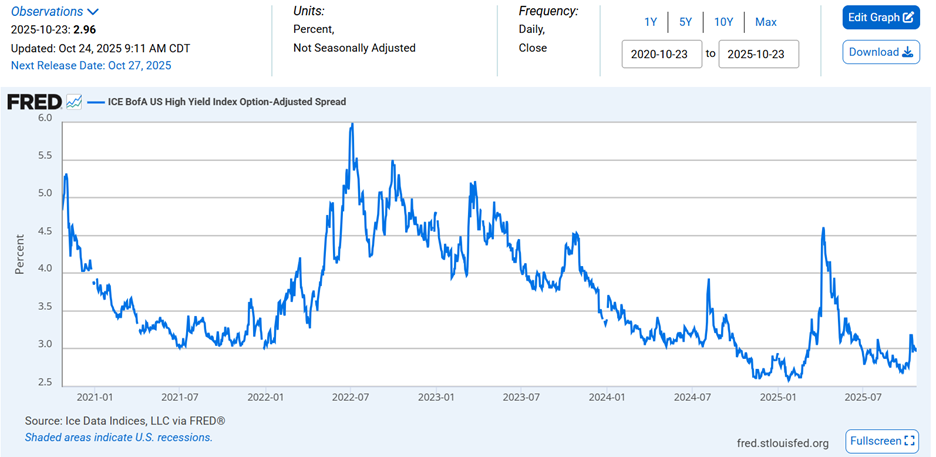

The stock market is setting new highs. Credit markets are booming, according to Barron’s. Credit spreads remain tight.

Gold has had a huge run in 2025. Gold has a low to negative correlation to stocks and bonds. Gold typically does best when liquidity is abundant.

Gold Year-to-Date

Meanwhile, inflation is still a problem. CPI was up 0.3% in September, while the core measure (excluding food and energy) was up 0.2% for the month. On a year-over-year basis, both measures were up 3%. The Fed’s Supercore gauge (core services excluding housing) climbed at a 4.7% annual rate over the most recent three months, according to Barron’s. It’s hard to imagine the Fed cutting the funds rate four to five more times by year-end 2026 with Supercore inflation pushing 5%.

It's worth pointing out that the market expects more rate cuts than the Fed itself is expecting. A fed funds rate of 2.75% to 3.00% is below the Fed’s Summary of Economic Projections (SEP) median projection of 3.4%. It’s also perilously close to the Fed’s year-end 2026 median 2.6% projection of core PCE. It would be unusual to have a Fed funds rate hovering just above the inflation rate. Bond investors seem to be signaling a recession ahead, which would cause the inflation rate to fall.

David Rosenberg of Rosenberg Research is concerned about just that. Major stock averages’ continuous march to records is, “a testament to the view that the S&P 500 has become completely disconnected from the real economy,” Rosenberg wrote this past week. Rosenberg thinks the economy is weakening significantly. He finds just 18% of the U.S. in expansion mode, down from 43% six weeks earlier. That’s the lowest percentage since May 2020. You would have to go back to July of 2009 to find such a low reading. That was before the pandemic and during the recession that accompanied the Great Financial Crisis.

Meanwhile, stock investors see blue skies ahead. Barron’s latest Big Money Poll showed that 47% of professional investors are upbeat about the market in the coming 12 months. That is up from 28% in the spring, which was the lowest reading since 1997, according to Barron’s. The bullishness is likely the result of the nearly 40% rally in the S&P since the April low. Bearish investors have fallen to 19% from 32% in April.

We’ve written a few times recently that bond investors are the realists while stock investors are the optimists. Currently, it appears that bond investors are expecting the economy to continue to slow. Possibly even fall into recession in 2026. Stock investors don't seem to have the same qualms. Rather, they see the best of all possible worlds. To wit: continued economic growth, falling inflation, double-digit earnings growth, a Fed rate cut cycle, and a resolution to the tariff turmoil. It’s as if Voltaire’s Dr. Pangloss* has returned, this time as a stock market investor.

*Plangloss was Voltaire’s relentlessly optimistic character who argued that “this is the best of all possible worlds”, regardless of the evidence to the contrary.

(None of this newsletter is intended as specific or appropriate investment advice. Consult a financial planner or advisor for advice that may be appropriate for your situation.)

Regards,

Christopher R Norwood, CFA

Chief Market Strategist