Executive Summary

- The S&P 500 finished down 0.1% at 6,460.26 last week

- The S&P is up 9.8% on the year. Industrials and Communication Services are leading the way

- Personal income rose in line with expectations for July, climbing 0.4% up from 0.3% the prior month

- A weak payroll number on 5 September means a Fed rate cut on 17 September

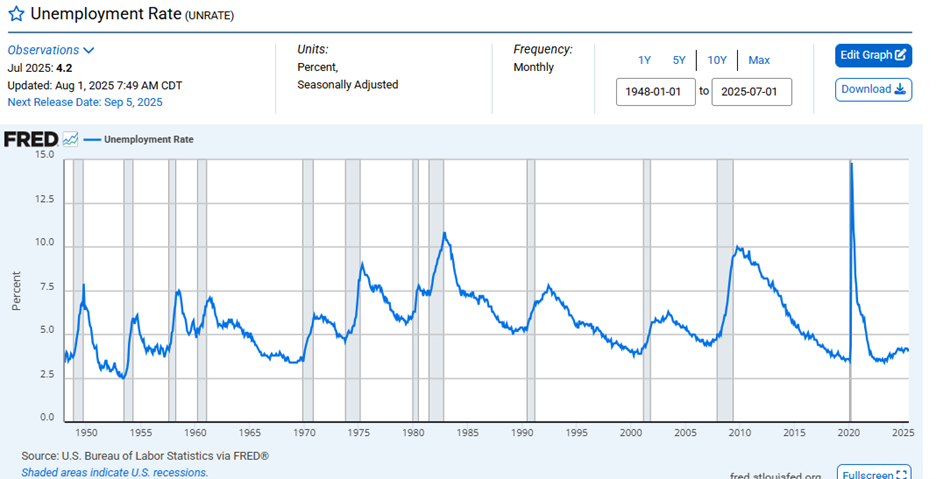

- Unemployment is expected to rise, but it is still low relative to history

- Wage growth close to 4% will make it hard for inflation to fall to 2%

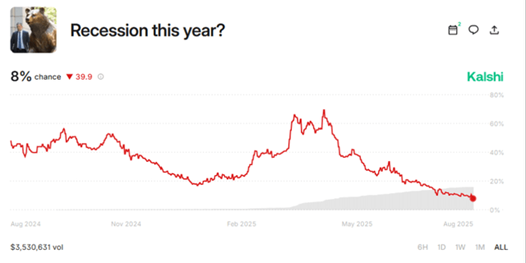

- The predictions market has the odds of a recession at 8%

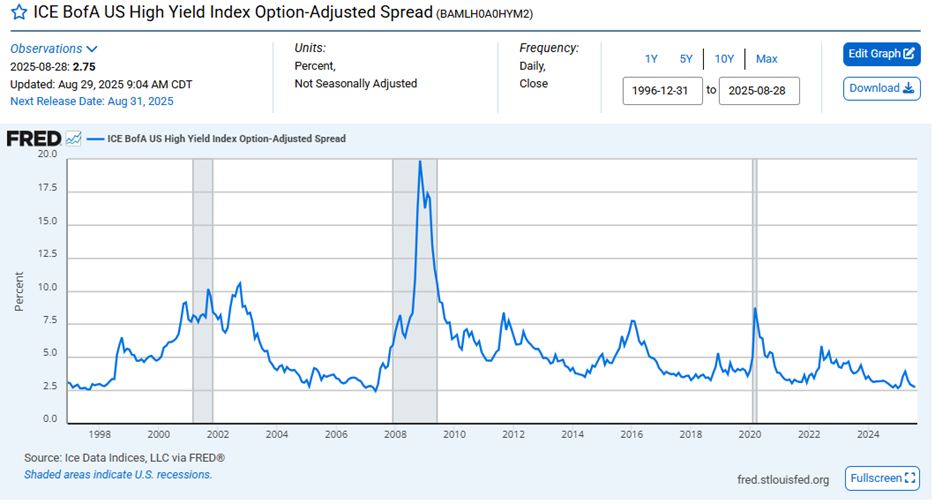

- The ICE BofA US High Yield Index spread is near all-time lows

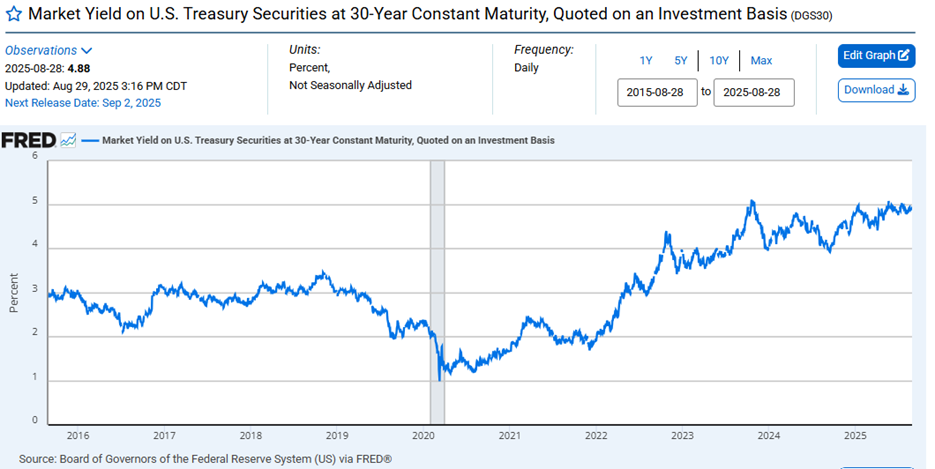

- A bear steepener is increasingly likely. A bear steepener is when the yield curve falls at the short end but rises at the long end

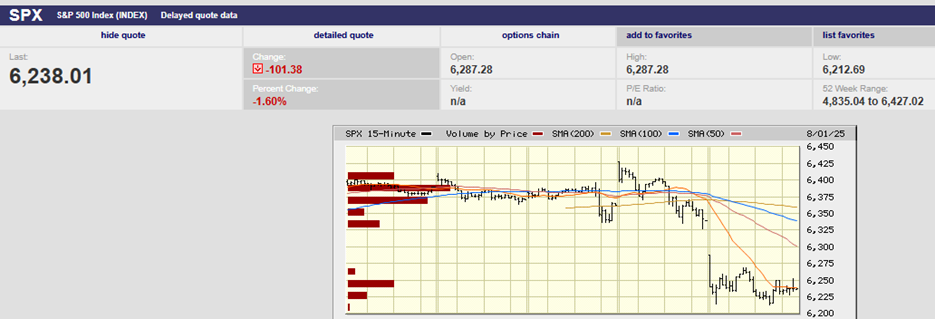

S&P 500 5-Day Chart

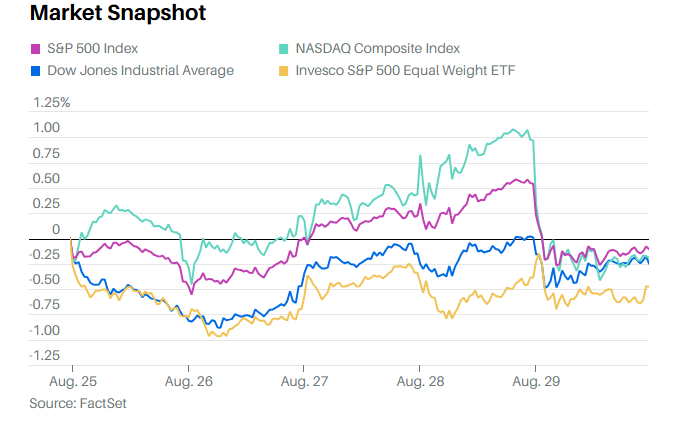

The S&P 500 finished down 0.1% at 6,460.26 last week. The index peaked for the week at 6,508.23 on Thursday. It gapped down at the open on Friday, giving back all its weekly gains by Friday’s close.

The S&P is up 9.8% on the year. Industrials are leading the way with a return of 15.37% year-to-date. The top stock in 2025 in the industrials sector is GE Vernova, which used to be part of GE. It’s up 86.35% in 2025. GE Aerospace is the second-best performer, up 65.0%. Communications Services are the next best sector with a gain of 15.06%. Communications services include Netflix, Meta, and Alphabet. Netflix is the top-performing stock in the communications services sector. It's up 35.56% year-to-date. AT&T is third with a gain of 28.63% year-to-date.

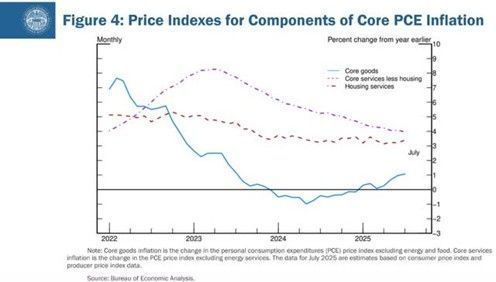

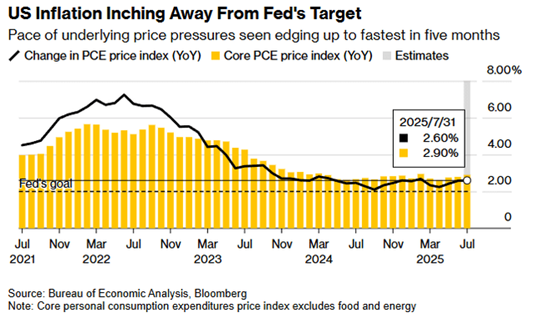

Friday’s selloff might have been due to the economic data released before the open. The most important data was the Personal Consumption Expenditures Index (PCE). The index rose 0.2% in July, down from a 0.3% rise in June. The year-over-year number was 2.6%, unchanged. The core PCE number rose 0.3% in July, as expected. The year-over-year number rose to 2.9% from 2.8%, also as expected. The Fed’s target is 2.0%. It doesn’t appear as if the PCE data was the culprit, given the lack of negative surprises.

Personal income rose in line with expectations for July, climbing 0.4% up from 0.3% the prior month. Personal spending rose 0.5%, up from the prior month’s 0.4%, but again in line with expectations. It doesn’t appear as if the rest of the data out Friday morning gave investors a reason to sell either. Let’s call it good old-fashioned profit-taking.

The payrolls number on 5 September should shed light on the Fed’s rate decision on 17 September. A weak report will make a rate cut a foregone conclusion. The CME FedWatch tool places the odds of a quarter-point cut at 86.4%, up from 84.7% a week ago. The Jobs report on Friday is expected to show an increase of 75,000 in August, up from 73,000 the prior month. A stronger-than-expected jobs report could spark a sell-off. Investors are leaning hard into a rate cut. A strong jobs report would create doubt. Investors hate uncertainty.

Unemployment is expected to rise to 4.3% from 4.2%. Anything under 5% is low relative to history, though.

Also, producer and consumer inflation data come out before the Fed meeting. Producer data comes out on the 10th. Consumer inflation data is reported on the 11th. Hourly wages are forecast to rise by .3% in August and 3.7% year over year. Hourly wages rose 3.9% year-over-year last month. Wage growth close to 4% will make it hard for inflation to fall to 2%.

The recent economic data doesn’t provide a reason to cut the Fed funds rate. Second quarter GDP was revised up last Thursday to 3.3%. The original number reported was 3.0%. The Atlanta Fed’s GDPNow tool is estimating Q3 growth of 3.5%, well above trend.

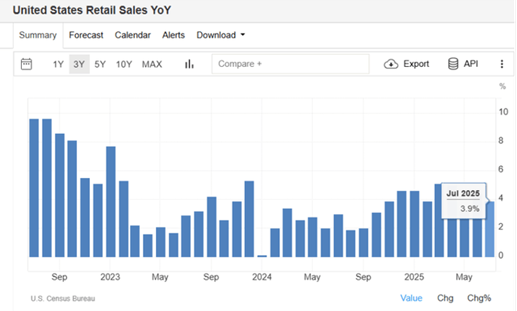

Retail sales in July were up 3.9% on a yearly basis.

Consumers continue to spend. Imagine the Fed cutting interest rates with the current data. Unemployment is below 5%, GDP growth is above 3% and the stock market is hitting all-time highs. It looks as if we don’t need to imagine it. Instead, we seem to be about to witness it.

Meanwhile, the odds of a recession have fallen throughout the year. The predictions market has the odds at a measly 8%.

(Kalshi is an CFTC-regulated exchange dedicated to trading on the outcome of future events. From inflation, to fed rates, to unemployment, to will the government shut down, Kalshi allows people to trade on a broad range of topics.)

Absent a recession, it's unlikely that the labor market will weaken much in the next few quarters. It’s also unlikely that the inflation rate will continue to fall in the next few quarters.

On the contrary, it appears as if the Fed’s favorite measure, core PCE, is set to continue rising. It hit a five-month high with last week’s report, rising to 2.9% on an annual basis from 2.8%.

Fixed-income investors are better than equity investors at sniffing out inflation. They are also better at gauging economic activity. Interest rate movements suggest bond investors have their doubts about inflation. They also don’t seem worried about a recession.

The ICE BofA US High Yield Index is near all-time lows. The index measures the spread between high-yield bond yields and the equal maturity Treasury. Tight spreads mean bond investors are not expecting economic stress any time soon. The ICE BofA Index is a leading economic indicator.

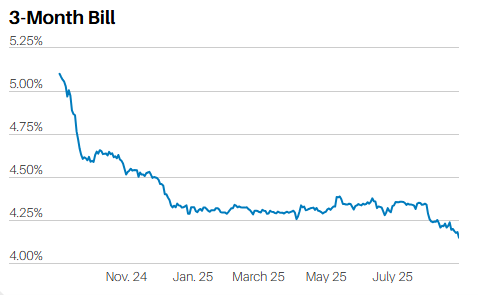

The 3-month Treasury is signaling that bond investors expect a rate cut in September. The chart above shows the 3-month yield falling below 4.25% in August.

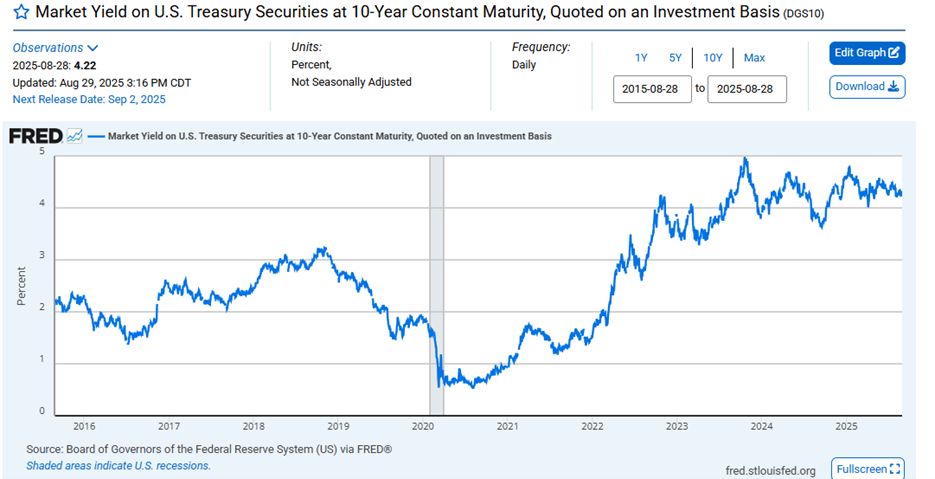

The 10-Year Treasury yield has traded for the most part in a range between 4.0% and 5.0% since the second half of 2023. Bond investors do not appear willing to bid up 10-year prices. The 10-Year yield finished Friday at 4.23%

The 30-year Treasury yield is testing 5% again. It appears bond investors are expecting yields at the longer end of the curve to move higher. How the long end of the yield curve acts if/when the Fed cuts will be key to monetary policy in 2026. The 30-year finished Friday at 4.93%.

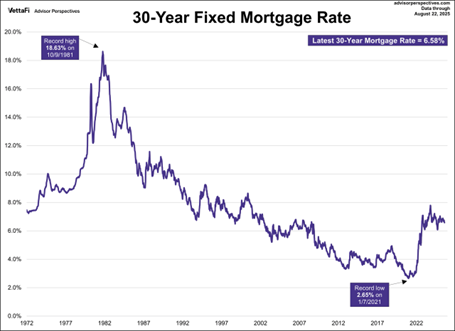

We wrote last week about the possibility of a bear steepener. A bear steepener occurs when the yield curve falls at the short end but rises at the long end. And it is longer-term rates that have the most impact on economic activity. The 10-year is particularly important since it is tied to the 30-year fixed mortgage rate. The 30-year fixed is currently around 6.58% (chart below)

Investors would do well to keep an eye on the long end of the yield curve in the coming months. A break above 5% for the 30-year and a move back toward 5% for the 10-year would likely pressure stock prices. Bond investors are historically better than equity investors at predicting interest rate movements and economic activity. They seem to be leaning toward higher long-term rates for now. And that is a risk for the equity market.

Regards,

Christopher R Norwood, CFA

Chief Market Strategist