Norwood Economics has reduced interest rate and credit risk in its 401(k) and wealth management portfolios.

The changes were made in response to changing conditions in the economy.

There are risks associated with investing in bonds. Two main risks of investing in bonds are interest rate risk and credit risk. Rising interest rates result in falling bond prices, and falling interest rates result in rising bond prices. Bonds with longer maturities are more sensitive to changes in interest rates than bonds with shorter maturities. Duration is a measure of a bond’s price sensitivity to changes in interest rates. Duration is expressed in years.

For example, a 10-year Treasury has a duration of approximately 8.5 years, which means a 1% rise in 10-year interest rates leads to an 8.5% decline in the price of the bond. A 30-year Treasury has duration of approximately 19.3 years. A 2-year Treasury has duration of approximately 1.9 years. Two-year Treasuries will lose only 1.9% if rates rise by 1% while 30-year Treasuries will lose 19.3% if rates rise by 1%. Clearly, it is better to own higher duration bonds in a falling interest rate environment, and lower duration bonds in a rising interest rate environment.

Interest rates are still near all-time lows, even with the recent rise (mostly at the short end of the yield curve). It is highly likely that interest rates will be substantially higher in 10-years, for a variety of reasons, including rising inflation and rising government debt levels.

We’ve sharply lowered duration in our portfolios because 1) the yield curve has flattened to a point where investors aren’t receiving much additional yield for taking on interest rate risk 2) interest rates are likely to rise over the next 10-years, putting pressure on bond prices and resulting in potentially large losses to bond holders.

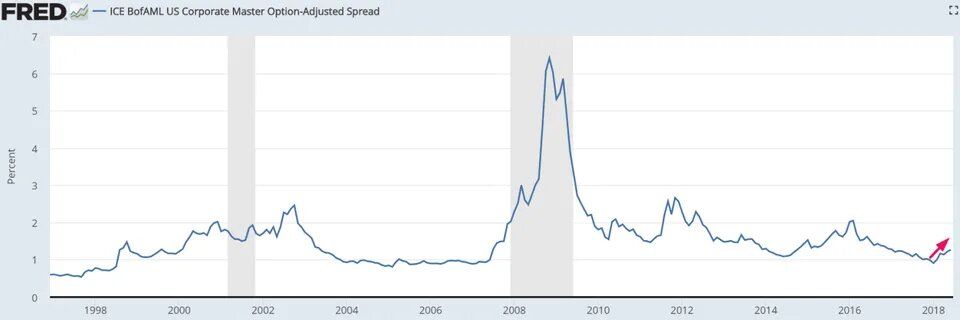

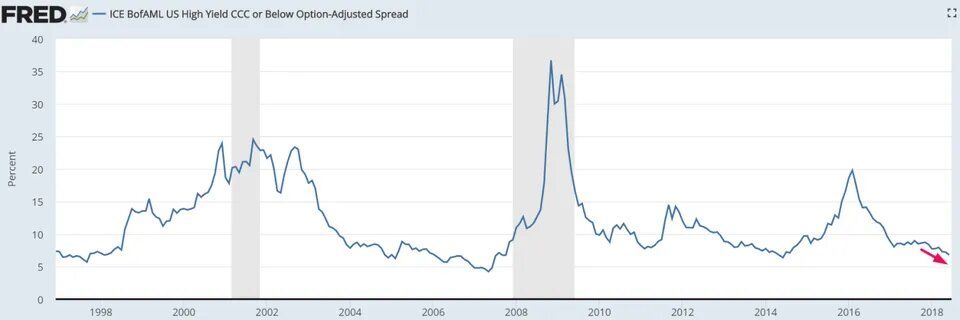

Credit risk is another main risk of bond investing. Treasuries are risk free and thus act as the benchmark for credit risk in the bond market. All other types of bonds trade at a spread above Treasuries, commensurate with the amount of credit risk associated with each bond. Corporate investment grade bonds have less credit risk than high-yield, non-investment grade bonds and thus trade at a tighter spread over Treasuries than do high-yield bonds. Corporate investment grade and high yield spreads are currently tight.

Investment Grade corporates are starting to trend higher (see above). High Yield spreads are still trending lower (see below). However both investment grade and high yield spreads are near 20-year lows.

Additionally, there has been a large increase in BBB rated corporate debt since the Great Recession. Triple B debt is the lowest rated investment grade debt. The BBB corporate bond market has ballooned from $700 billion to $3 trillion since the last recession. Investors typically think of investment grade debt as low-risk and most are likely unaware that BBB corporate debt now makes up almost half of the $6 trillion investment grade corporate bond market. It is likely that downgrades to junk (high-yield) will catch many investors by surprise as BBB rated companies struggle with meeting interest and especially principal payments during the next recession, as corporate cash flows come under pressure from deteriorating economic conditions.

Norwood Economics has recently reduced credit risk in our wealth management portfolios by shifting from corporate investment grade index ETFs to bond index ETFs holding primarily government debt. Corporate debt is trading near 20-year lows to government bonds. Credit risk is rising inside the investment grade universe as BBB bonds continue to make up a larger and larger percentage of investment grade debt. We expect a recession sometime within the next few years – likely the second half of 2019 or first half of 2020. Downgrades and defaults will increase and corporate bond prices with adjust downward accordingly with corporate spreads widening to more normal levels.