Executive Summary

- The S&P 500 fell 0.3% to close the week at 6,259.75

- We would rather own the German economy than Nvidia

- Consumer spending is weakening

- The consumer price index report will be released on Tuesday

- Economists believe that tariffs will cause prices to rise

- Economists believe that tariffs will slow the economy

- The jobs market is stable. The unemployment rate is low.

- Earnings estimates are falling more than is normal

- There are still good companies on sale

The Stock Market

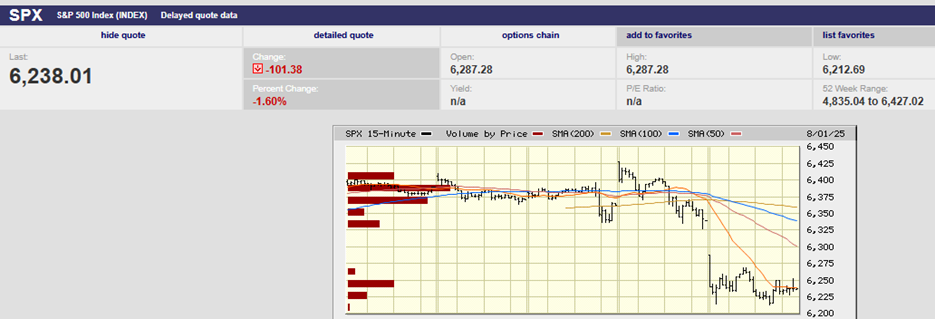

S&P 500 5-Day Chart

The S&P 500 fell 0.3% to close the week at 6,259.75. The Nasdaq rose 0.2%, getting a boost from Nvidia. The latter surpassed $4 trillion in market cap last week. Nvidia is now worth more than the total capitalization of the U.K., German, or French equity markets, Deutsche Bank strategist Jim Reid observed Friday. There is little chance that Nvidia will outperform the U.S. stock market over the next 10 years. And that is because the company is NOT worth more than the British, German, or French stock markets.

Ask yourself whether you'd rather own the German economy or the company that is Nvidia. Most people, upon reflection, would want to own the German economy. After all, Nvidia might not even exist as a company in 20 years. The failure rate of individual stocks is high. A J.P. Morgan study found that approximately 40% of stocks suffered a permanent decline of more than 70%. A second study of stocks between 1926 and 2016 found that over 50% of all stocks delivered negative lifetime returns. The most frequent lifetime loss was 100%. In contrast, the German economy will still be here 20 years from now, generating wealth. (We made this same argument about Apple a few years back. AAPL stock has underperformed the S&P by 30% since then.)

The S&P is up 6.43% year-to-date. Industrials still lead the way, up 14.00% YTD. Technology is second with a gain of 10.03% followed by communications services, which is up 9.50%. Healthcare brings up the rear with a loss of 1.73% YTD. Consumer discretionary is next worst with a loss of 1.30% on the year. It’s noteworthy that Consumer Discretionary is down in 2025. The sector has gained 17.15% over the trailing 12 months. The recent underperformance could signal that consumer spending is weakening. Consumer spending makes up 70% of GDP.

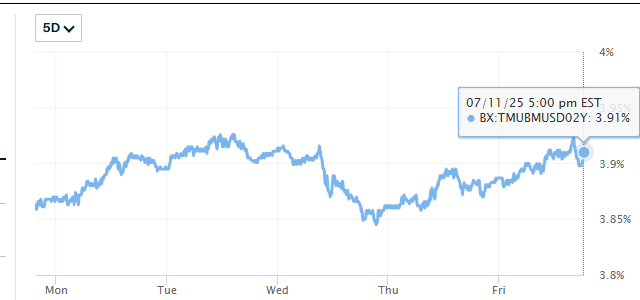

The two-year Treasury yield finished the week at 3.91% up a few basis points.

2-Year Treasury Yield 5-Day Chart

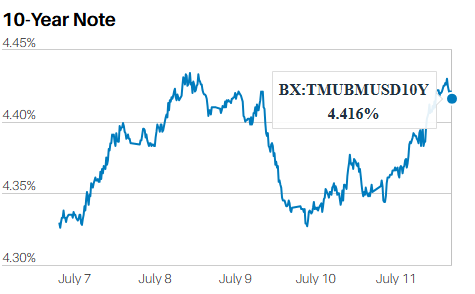

The 10-year yield ended the week at 4.41%, up around 8 basis points from the prior week’s close.

10-Year Treasury Yield 5-Day Chart

Rising rates, particularly at the long end, are a problem for the Fed. It only controls the Fed funds rate, the overnight lending rate between banks. It doesn't control the rest of the yield curve. The bond market may push longer-term rates higher if it sees deficits as inflationary. Longer-term rates rose last fall when the Fed began cutting. They may do so again if the Fed resumes cutting this fall. Inflation fears are already percolating among fixed-income investors due to the tariff wars.

Longer-term rates can also rise due to credit concerns. Rate cuts allow the federal government to keep deficit spending. That's because falling rates make financing debt easier. But eventually, investors begin to wonder if they'll get their money back. Debt growing faster than the economy isn't sustainable. At some point, investors refuse to lend more. Regardless of the reason, rising long-term rates would pressure earnings.

The consumer price index report will be released on Tuesday. The June estimate is 0.3% for core CPI, seasonally adjusted. Year-over-year core CPI is forecast to rise to 3.0% from 2.8%. Year-over-year numbers aren’t seasonally adjusted. We wrote a few weeks ago about the likelihood of inflation picking up into year-end. We are beginning to see that now.

Economists believe that tariffs will cause prices to rise. Some economists see a one-time price hike. Others see rising inflation on an ongoing basis. Economists also believe that tariffs will slow the economy. How much is up for debate. High Frequency Economics chief Carl Weinberg thinks tariffs will serve as a massive tax increase. Piper Sandler economist Jake Oubina writes that cash-strapped consumers may tighten their belts. The potential headwind from tariffs is 10 times the stimulus coming from the Big Beautiful Bill, he adds in a client note. The drag on the economy due to rising tariffs isn’t in the data yet. Nor are the price hikes. But tariffs are bound to impact consumer and business spending. It's a question of when.

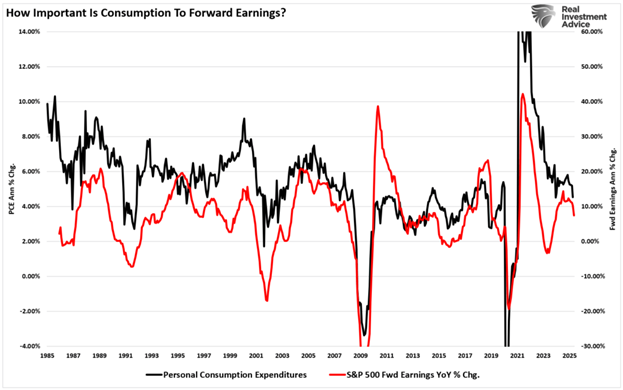

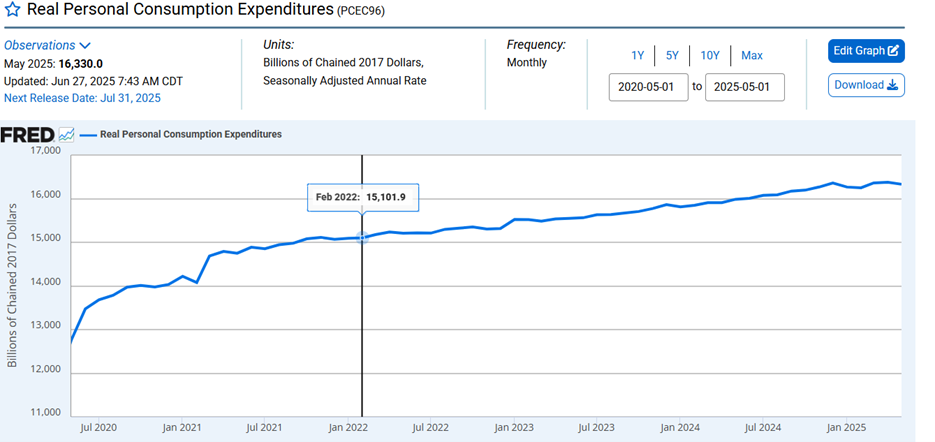

And consumption is very important to S&P 500 earnings.(see chart above)

Retail sales for June will be released on Thursday. They fell 0.9% in May, down 0.3% excluding autos. Consumer spending has held up so far, though. Real final sales to private domestic purchasers increased by 1.9% in the first quarter. The metric is a key economic indicator. It reflects total spending by consumers and businesses. It strips out international trade, changes in inventories, and government spending. It's calculated by summing personal consumption expenditures (PCE) and gross private fixed investment. The metric highlights the strength of demand within the U.S., excluding external factors. The next report on Real Final Sales to Private Domestic Purchasers is scheduled for July 30th, according to the St Louis Fed.

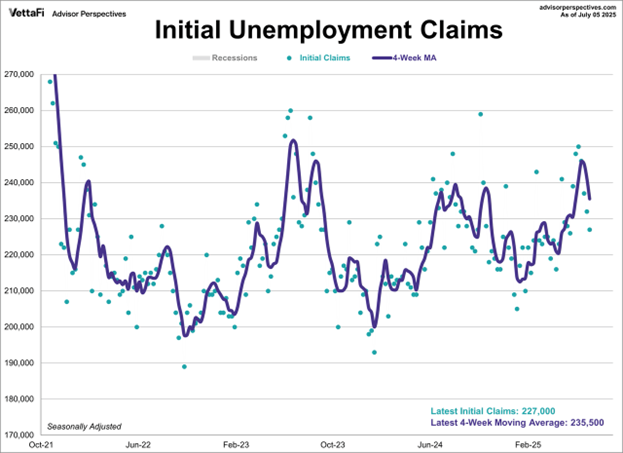

Initial jobless claims fell to 227,000 last week from 232,000 the prior week. The four-week moving average stands at 235,500, down 5,750 from the previous week.

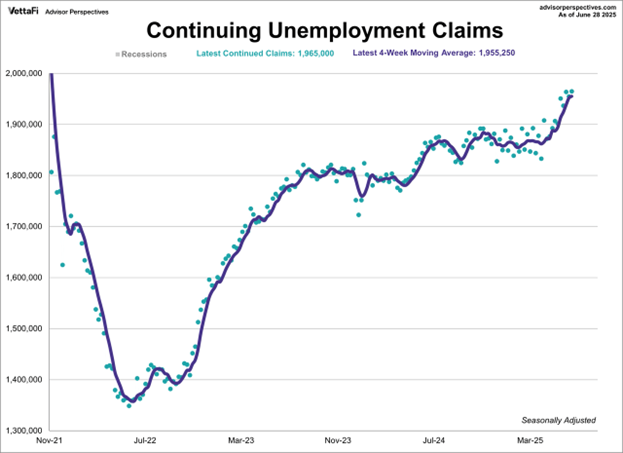

Data for continuing claims (chart below) has a one-week lag compared to initial claims. In the week ending June 28th, continuing jobless claims were at a seasonally adjusted level of 1,965,000. That is the highest level since November 2021. It represents an increase of 10,000 from the previous week's figure. The latest reading was lower than the 1,980,000 forecast.

The jobs market is stable. The unemployment rate is low. The June jobs report (lagging indicator) was better than expected. But it is taking workers longer to find new jobs based on the continuing claims data (chart above). The Fed is looking at the employment numbers. It is the second of its dual mandates. The first is price stability.

Earnings season is upon us. Investors are expecting a tariff fallout to hit in the second half of 2025. You wouldn’t know it based on the record-setting stock market. The S&P 500 trades at 22.4 times 12-month forward earnings. That is its highest valuation over the past three years, according to Barron’s. Analysts expect S&P 500 sales to grow 3.8% year over year, according to FactSet. Earnings are forecast to grow by 3.5%. That isn’t great earnings growth given the stock market’s valuation. Guidance will be crucial. There is nervousness on Wall Street. The fear is that outlooks will either disappoint or not be provided.

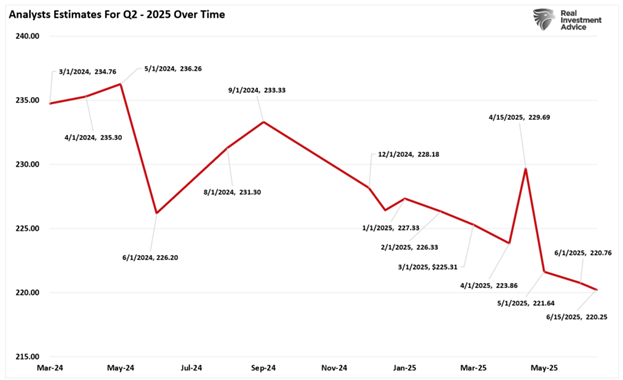

As it is estimates have been falling.

According to data from S&P Global, the Q2-2025 earnings estimates have declined from $234/share to $220/share. The original estimate was as of March 2024. The current estimate is as of June 15th 2025. The $14 drop in estimates is partly due to the impact of tariff concerns on corporate outlooks.

According to Fact Set:

- “Heading into the end of the quarter, analysts have reduced earnings estimates for S&P 500 companies for the second quarter more than average. In addition, the index is expected to report its lowest year-over-year earnings growth rate since Q4 2023 (4.0%).

According to Lance Roberts of RIA there are three reasons earnings estimates are falling more than is normal. First tariffs. Industry groups and strategists at Goldman, Bank of America, and Citi warn tariffs may shave off ~1–2% EPS growth per 5 percentage points increase in effective duty rates. Trump’s 9 July deadline was pushed back to 1 August, dragging out the uncertainty.

Second, there is a concern among analysts that consumer spending is weakening. The latest Personal Consumption Expenditures (PCE) report was released on June 27th. PCE rose 0.1% for May with an annual increase of 2.3%. Consumer spending decreased by 0.1%. Personal Income decreased by 0.4%. Goods spending decreased by $49.1 billion. Services Spending increased by $19.9 billion.

And Third (Roberts writes):

“Lastly, the downturn in energy and materials earnings directly reflects economic weakness. The Q2-2025 earnings for the energy sector declined by ~19%, while materials fell by ~12% year‑over‑year. The decline in those two sectors is important given their reflection of economic activity.”

The stock market is expensive. Interest rates remain high. Inflation is above target and beginning to rise once again. Earnings estimates are coming down. There is great uncertainty about the impact of tariffs on earnings. A 10% plus pullback is a growing possibility. It would also be normal.

There are still good companies on sale. The challenge is finding them.

Regards,

Christopher R Norwood, CFA

Chief Market Strategist