Executive Summary

- The S&P 500 rose 3.4% last week, climbing to 6,173.07

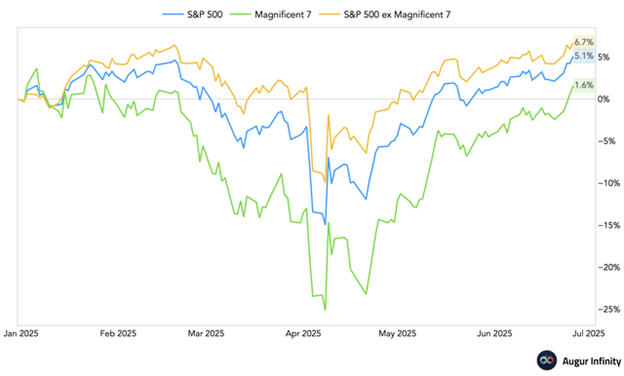

- The Magnificent 7 are outperforming the S&P 493 by over 18% since April

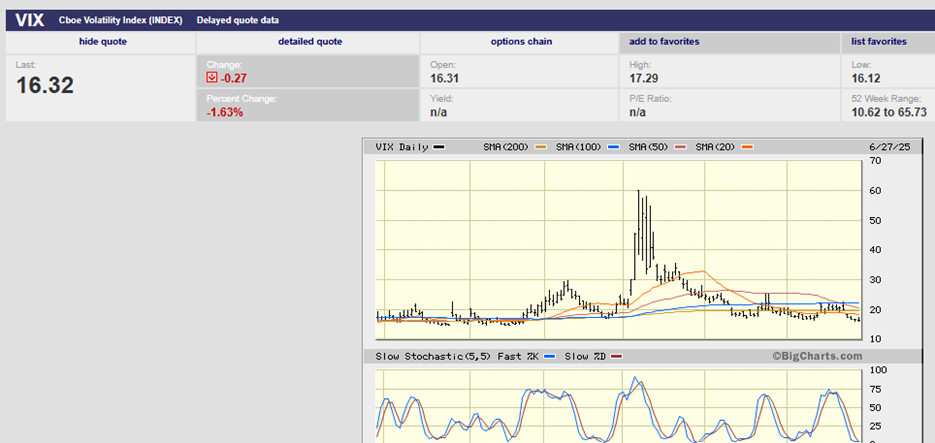

- The Cboe Volatility Index (VIX) fell as low as 16.11 last week

- Investors seem unconcerned about tariffs and war

- Treasury interest rates are starting to fall

- The Fed has little reason to cut if unemployment isn't moving higher

- The stock market is at record highs

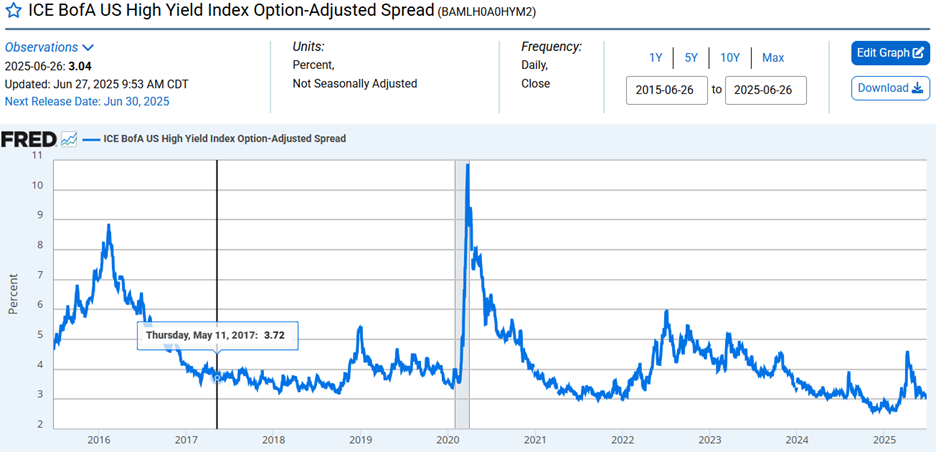

- Corporate bond spreads are tight, meaning credit is abundant

- The dollar has fallen by around 10% in 2025

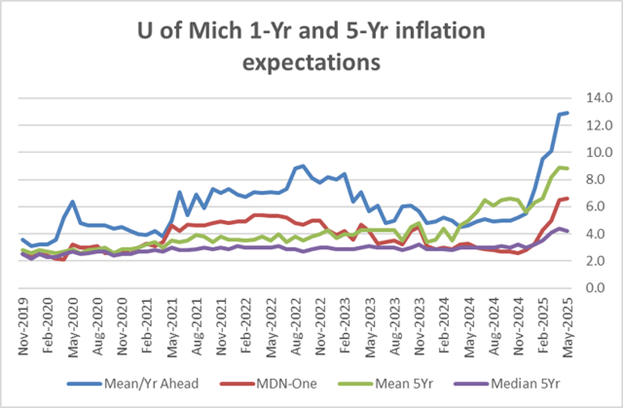

- Inflation is expected to move higher because of tariff

The Stock Market

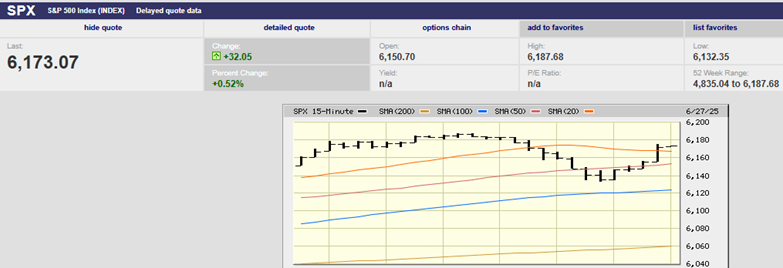

The S&P 500 rose 3.4% last week. The Israeli-Iranian ceasefire was credited with the surge to the upside. The index had lost 0.7% over the prior two weeks.

S&P 500 breaking above its recent trading range. (30-day chart above)

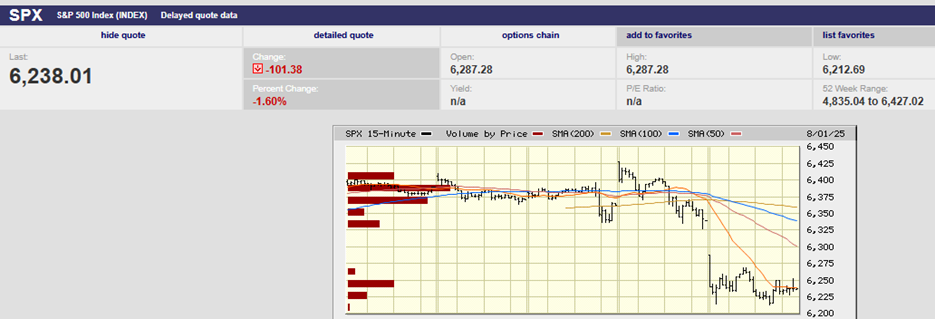

S&P 500 5-Day Chart

Last week was a mostly straight-up affair. Wednesday saw a small give-back before the advance continued. (chart above). The S&P did run into some selling on Friday. It reached an early high of 6,187.68 before falling to 6,132.35, starting around 1:15. Buyers stabilized the S&P over a 45-minute period beginning at 2:30. They pushed the index back toward 6,180 in the last half hour of trading. (see chart below).

S&P 500 One-Day Chart

The S&P has resumed its uptrend begun 7 April. (chart below). The index bottomed at 4,835.04. It has gained 27.7% since the 7 April low. Of course, it lost 21.3% from 19 Feb. to the 7 April low before the recent rally. The S&P is up 4.96% in 2025.

S&P 500- 6-month chart

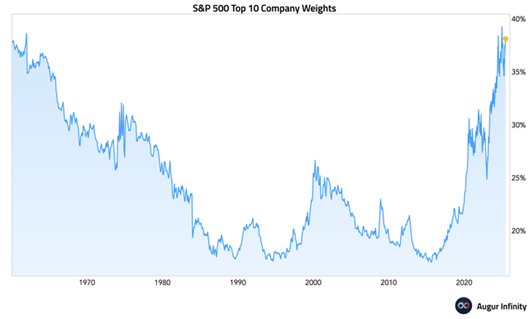

The broad market isn’t doing as well as the index. The gains since 7 April are courtesy of a handful of mega-cap stocks. The Mag7 trade is back. The top 10 concentration is nearing 40%, a level not seen since the 1960s.

The top 10 stocks accounted for a 25% share of the market during the bubble years of the late 1990s, according to Michael Kramer of Mott Capital. It is over 38% today. The S&P 500 market-cap-weighted index has returned to its all-time high. The S&P 500 equal-weighted index (RSP)remains 3% below its highs. The equal-weight S&P hit its record high in November 2024.

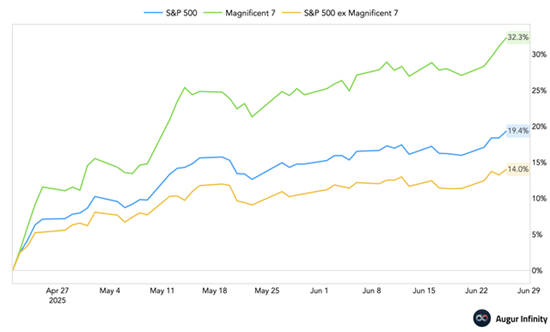

The Magnificent 7 have far outperformed the S&P 493 since April 21. The Mag7 has risen 32.3% while the S&P 493 has only increased by 14%. (chart below)

Since the beginning of the year, the S&P 493 has outperformed the Mag7 stocks, though. (chart below)

The problem with narrow advances is that they are more susceptible to a reversal. Correlations are higher which means less diversification. Less diversification means more risk. Three-month realized correlations have increased to around 90% across the seven stocks, according to Mott Capital.

For now, though, volatility has continued to fall from 60.13, hit on April 7th.

VIX Index 6-Month Chart

The index fell as low as 16.11 last week. The Cboe Volatility Index VIX is a real-time index that reflects the market's expected volatility over the next 30 days. It’s known as the “fear gauge” because it usually increases along with market uncertainty. Option traders can either hedge or speculate using VIX options. A low VIX index makes options cheaper. A high VIX makes options more expensive. Like the prediction markets, real money is invested (gambled?) when traders place their bets. The volatility index can go lower. It hovered in the 11’s a few times in 2024. But fear has subsided for now. A VIX of 16.11 means investors are not particularly concerned about the Middle Eastern conflict or the Tariff War.

The lack of fear bothers Liz Ann Sonders, chief investment strategist at Charles Schwab. “The risk again is that there is too much complacency and an overbought market,” she told Barron’s last week. “July 9th is front and center, and we have no idea how that will play out.”

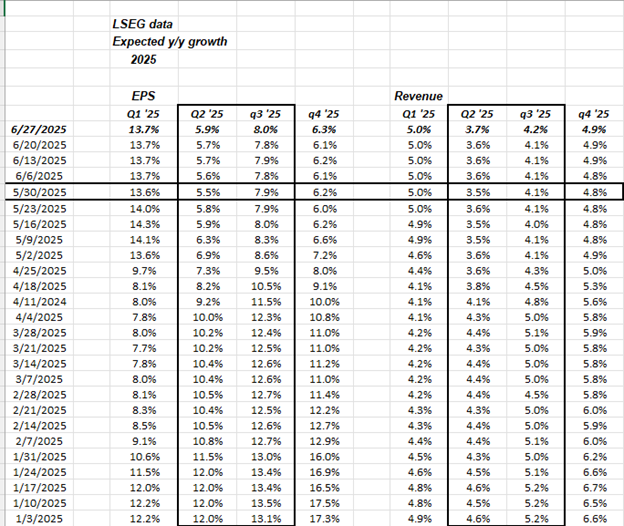

Sonders also pointed out that big businesses remain far more cautious. Profits could fall. Earnings and revenue growth estimates have been falling since the start of the year. (chart below). “The earnings outlook is murky right now,” she says. “We had a strong first quarter, but there was no extrapolation for the rest of the year.”

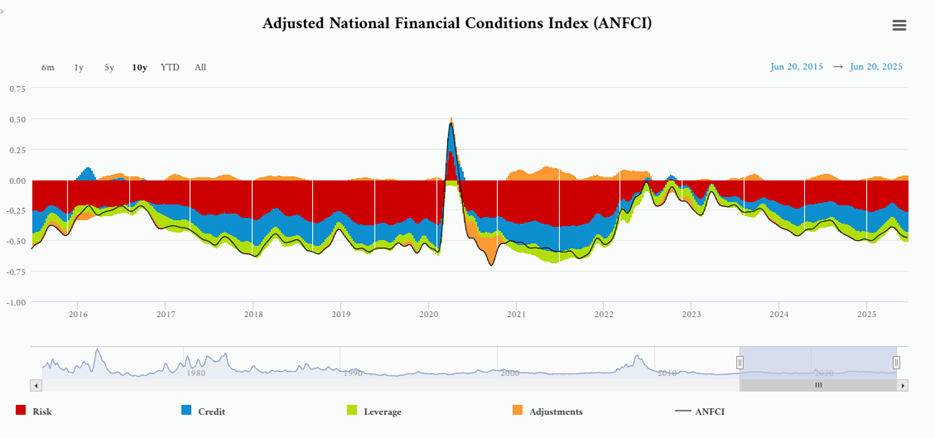

Financial Conditions are easy. That may help reverse the declining EPS and Revenue growth estimates. (Estimates may have bottomed already on 5/30 in the chart above.)

A negative number means that financial conditions are easier than normal. The National Financial Conditions Index has been easy for most of the last 10 years.

Credit spreads are near all-time lows. Corporations are having no trouble borrowing.

DXY 5-Year Chart

The dollar index is falling, which loosens financial conditions. (chart above)

Interest rates are starting to come down as well. The 10-year Treasury has dropped to 4.28%. The 2-year Treasury yields 3.78%. The entire Treasury yield curve from 2-Year to 10 is now below the current fed funds rate of 4.375%. Falling rates also loosen financial conditions. The yield curve falling below the Fed funds rate is the market telling the FOMC they are behind the curve. Crude oil has fallen to the mid-60s. Lower oil prices would also put pressure on the FOMC to cut the Fed funds rate. Powell and the other FOMC members are holding for now. Let’s not forget that the Fed is usually late.

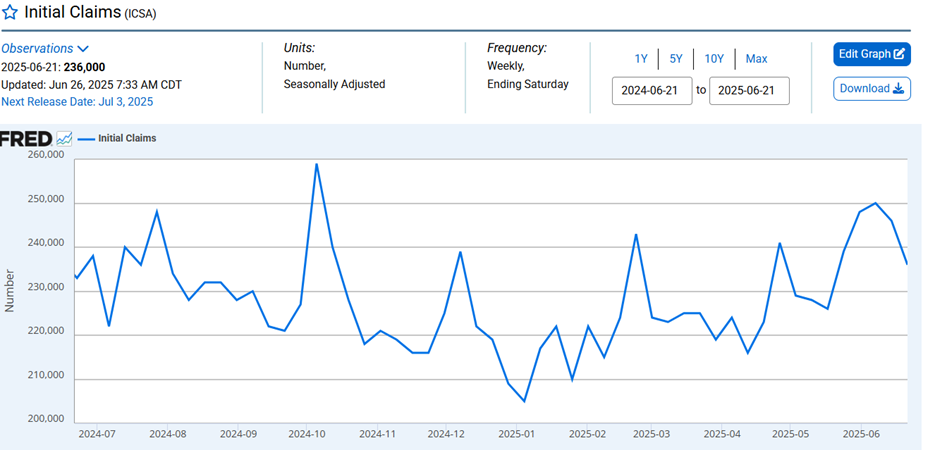

Yet unemployment isn’t rising. Initial jobless claims aren’t rising either (Chart Above). Unemployment is admittedly a lagging indicator. Initial jobless claims though are considered a leading indicator. What’s more, trends in the labor market make it less likely that unemployment will rise. The Fed has little reason to cut if unemployment isn't moving higher.

The consensus guess among economists is for a 125,000 rise in nonfarm payrolls in June. That would be down from May’s 139,000 increase. The jobs number will come out Thursday. The unemployment rate is expected to remain at 4.2%. It may drop.

Deutsche Bank economists estimate that only 100,000 new jobs are needed to keep unemployment steady. The average gain in the first five months of 2025 was 124,000. With no net immigration in flows, only 60,000 new jobs would keep the unemployment rate flat. With deportations, just 40,000 new jobs would hold unemployment steady. Then there is the baby boomer stampede out of the workforce. The surge in retirements is reducing the participation rate. A falling participation rate keeps downward pressure on unemployment. RBC Capital Markets Senior U.S. Economist Michael Reid writes that the U.S. needs more workers rather than more jobs.

The stock market is at record highs. Corporate bond spreads are tight, meaning credit is abundant. The dollar has fallen by around 10% in 2025, also signaling plenty of liquidity. Then there's inflation which is expected to move higher because of tariffs.

Given all the signs of easy money, it’s difficult to understand why the Fed would cut rates. Could bond investors and the yield curve be wrong? It wouldn’t be the first time.

Regards,

Christopher R Norwood, CFA

Chief Market Strategist