TARIFFS ARE A TAX ON AMERICAN CONSUMERS THAT HURT MANY, BUT ONLY BENEFIT A FEW.

Three statements which are true:

1) Tariffs are a tax on American consumers that hurt many but only benefit a few, leaving the country worse off.

2) Trade policy doesn’t impact trade deficits but does benefit some industries and companies over others. (Think politicians playing favorites)

3) Global supply chains are complicated and integrated. Disruptions caused by protectionism will cause prices to go up and production to grow more slowly, costing Americans jobs.

One at a time:

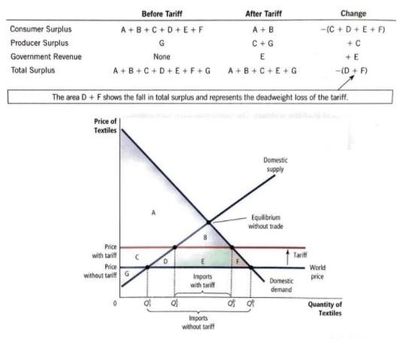

The chart to the right is from Principles of Economics, 8th edition by N. Gregory Mankiw. The chart is a visual depiction of the underlying math showing that Consumers are the big loser when a country imposes tariffs. Consumers individually, and the country as a whole, are worse off because of the tariff. Prior to the tariff, Consumer Surplus (benefit) is represented by letters A-F. Producer Surplus (benefit) is represented by the letter G. After the tariff, Consumer Surplus (benefit) shrinks to only A and B. Producer Surplus expands to G and C: Consumers lose far more than Producers gain. Although the government collects the tax (tariff) represented by area E, areas D and F are lost to all parties (consumers, producers, and the government). The country, as a whole, is worse off. Therefore, tariffs are a tax on American consumers that hurt many, but only benefit a few.

Trade policy doesn’t impact trade deficits, but it does benefit some industries and companies more than others. How is that possible if Presidents, current and former, have used trade policy to attempt to reduce the trade deficit?

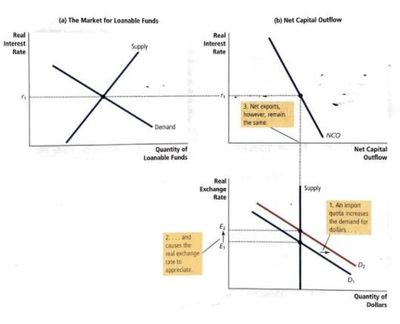

Let’s explore the graphs to the left:

Taxation of a product, or imposing an import quota, causes the real exchange rate to rise. American exports are more expensive when the real exchange rate rises. Higher export prices mean a drop in exports. The reduction in exports offsets the fall in imports, leaving net exports unchanged. Whether an import quota or tariff, the effect is the same - imports shrink (the intention of the tariff), but so do export. The trade deficit remains unchanged because net exports and the trade balance are one and the same.

It is true that the domestic industry receiving protection from the United States government gains, but the losses to other industry offset the gains from the fortunate beneficiaries of the President’s favoritism. Trade policy doesn’t impact trade deficits: it benefits some industries and companies over others.

Global supply chains are complicated and integrated. Disruptions caused by protectionism will cause prices to go up and production growth to slow costing Americans jobs.

From the article How Trade Tensions Will Test Companies and Investors (Barron’s Magazine, April 14, 2018):

Aluminum ingots shaped in Quebec smelting plants are shipped to Kentucky factories that roll them into sheets. Some are sent to Mexico, where they are installed in cars that later head through the Americas and to Asia. U.S. semiconductor manufacturing equipment that includes Chinese parts is shipped back to Asia, where manufacturers use them to churn out chips later installed in electronics that allow American teenagers to send selfies across the world. This is the way the world works today.

Tariffs are directly affecting businesses that depend on imported steel or that export wine or pork to China. Farmers are feeling “particularly vulnerable to retaliation,” Federal Reserve policy makers said in the most recent meeting minutes. “The long-term effects of tariffs would be catastrophic,” says David Rodibaugh, who raises pigs, corn, and soybeans on his Indiana farm. “It would change the playing field entirely” Goldman Sachs estimates that the steel tariffs will cost GM and Ford $1 billion each if they go into effect (costing American Jobs).

40% of the value of U.S. imports from Mexico comes from materials and parts produced in the United States. The U.S. Chamber of Commerce has calculated that six million American jobs depend on U.S.-Mexico trade.

Or Consider Arrow Fastener Co., a manufacturer in Saddle Brook, N.J., that may now hire fewer U.S. workers and cut production because of Trump’s steel tariffs.

From How Trade Tensions Will Test Companies and Investors (Barron’s Magazine, April 14, 2018):

“Arrow has been manufacturing heavy-duty staple guns, nail guns, and staples since 1929, and employs 280 people, 225 on its factory floor. The company buys all of its steel from China because it can’t find a domestic supplier or a supplier in Canada or Mexico. If the company does see its steel costs rise by 25%, it may stop making staples domestically (costing American jobs),” according to Gary DuBoff, Arrow’s president and chief executive.

It is self-evident: Global supply chains are complicated and integrated. Disruptions caused by protectionism will cause prices to go up and production to grow more slowly, costing Americans jobs.

Tariffs hurt American consumers, and American companies.