Executive Summary

- The S&P 500 rose 0.5% last week to finish at 5,667.56 breaking its four-week losing streak

- The uncertainty surrounding the trade war will weigh on the economy and capital markets for the foreseeable future.

- Economists and the public aren’t sure whether to worry about inflation, weakening economic growth, or both.

- The Summary of Economic Projections (SEP) signals two rate cuts and a higher year-end inflation number

- Invoking the Alien Enemies Act of 1798 will lead to higher prices

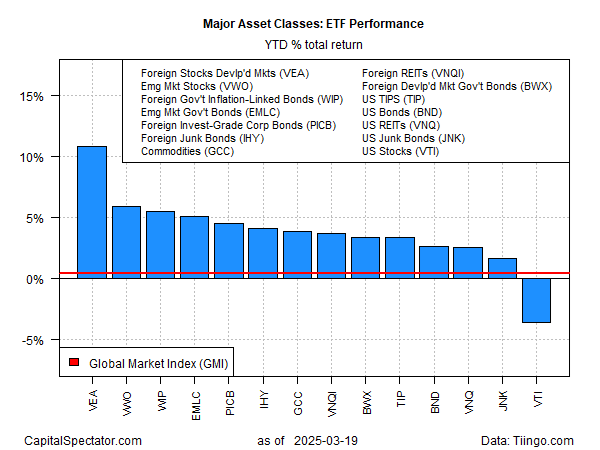

- U.S. stocks are the only asset class losing money in 2025

The Stock Market

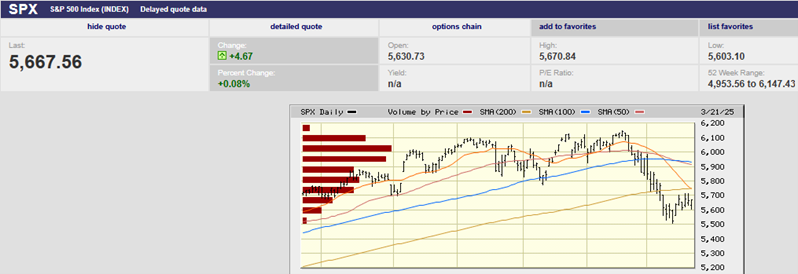

The S&P 500 rose 0.5% last week to 5,667.56. The Nasdaq rose 0.2% and the Dow was up 1.2%. The S&P broke a four-week losing streak. It was due for an oversold bounce. We wrote last week, “The S&P is primed to bounce this week, likely at least back to the 200-day moving average residing at 5,740.” The S&P did bounce but only reached 5,715.33 on Wednesday around 3 p.m. Fed Chairman Powell was speaking soothing words at the time to investors during his press conference following the Federal Reserve FOMC meeting. The S&P couldn’t build on Wednesday’s late gains though, although it did try.

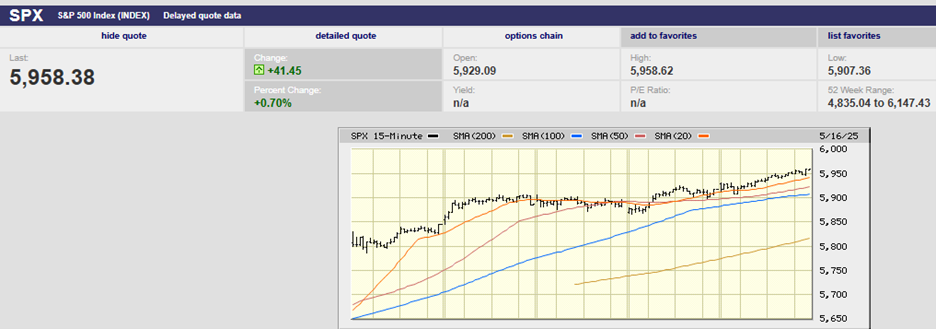

S&P 500 5-Day Chart

The S&P opened down Thursday, falling to 5,632.33 in the first 15 minutes of trading. It climbed back by 10:30 to just short of the 5,715.33 Wednesday high only to start another decline. The index touched 5,603.10 early Friday morning. It spent the rest of the day recovering. A late push in the last 30 minutes of trading ensured a gain for the week. All in all, it wasn’t much of a bounce and fell short of first resistance at the 200-day moving average.

S&P 500 6-Month Chart

We also wrote last week, “The next resistance is around 5,800. There is also stiff resistance in the 5,900 – 6,100 range, which was the market’s trading range for the last four-plus months.” It’s unlikely that the market will clear the 200-day M.A. at 5,740 let alone push through resistance to a new high. There would need to be a marked improvement in the trade war news first. The 20-day is falling below the 200-day. The 50-day is falling through the 100-day M.A. Too much damage has been done to expect the uptrend to re-establish itself anytime soon. Again, it would take a major improvement on the trade war front first. That seems unlikely in the near term.

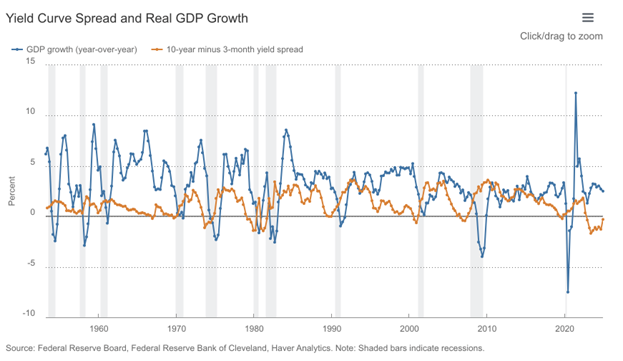

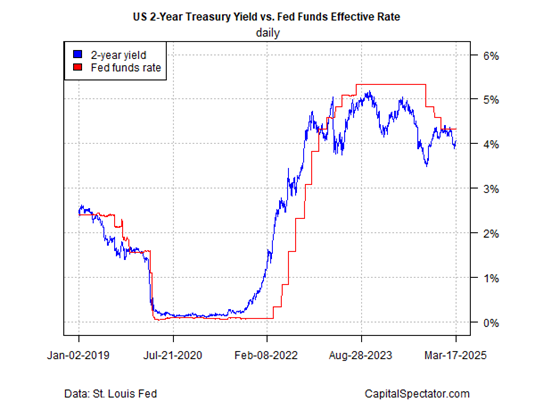

The Russell 1000 Value index gained 1% last week. The Russell 2000 small-cap index rose 0.5%. The 2-year Treasury yield fell to 3.96% while the 10-year Treasury yield ended the week at 4.25%. The 3M/10Yr yield curve is still inverted. It is a reliable recession indicator but with long and variable lead times (see below chart).

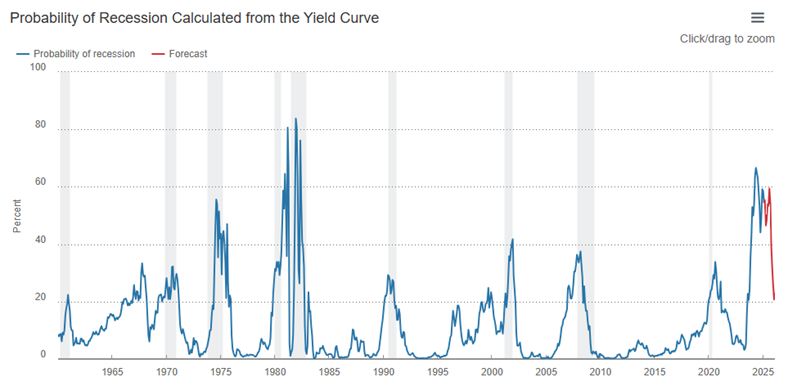

The Cleveland branch of the Federal Reserve pegs the probability of a recession at about 20%. (chart below)

The uncertainty surrounding the trade war will weigh on the economy and capital markets for the foreseeable future. Uncertainty leads to less consumer spending and less business investment. Tariffs are a tax which means tariffs will have a negative impact on the economy. Tariffs also cause prices to rise. The Federal Reserve updated its Summary of Economic Projections (SEP) at last week’s meeting. It indirectly acknowledged both the contractionary and inflationary consequences of tariffs. One need only look at the FOMC members updated forecasts.

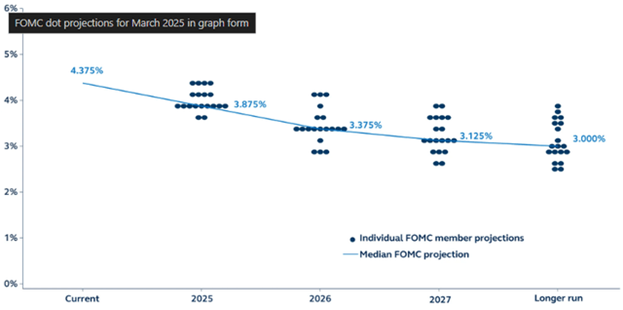

The Fed’s updated SEP signals two Fed funds rate cuts of one-quarter percentage point in 2025. The current Fed funds range is 4.25% to 4.50%. Those cuts are forecast despite FOMC members raising their median core Personal Consumption Expenditures (PCE) price index forecast. The median forecast for the year-end 2025 core PCE price index is 2.8%. The median forecast was 2.5% in the December SEP.

Two rate cuts combined with a higher forecast inflation level by year-end appear puzzling at first. But there is an explanation. The Fed is expecting the higher for longer inflation rate to be temporary. The FOMC members left the median core PCE for year-end 2026 and 2027 unchanged at 2.2% and 2%. Furthermore, members revised their 2025 GDP growth forecast lower to 1.7% from 2.1%. The Fed also now expects GDP growth in 2026 of 1.8% down from 2.0%. It sees GDP growth of 1.8% in 2027 down from 1.9% as well. The other reason the Fed is leaving two rate cuts on the table for 2025 may be because of unemployment. The unemployment forecast was raised to 4.4% from 4.3% for year-end. Unemployment was 4.1% in February. The trend may be worrying Fed officials.

It's a tug of war then. Inflationary pressures on one side and slowing economic growth on the other. The Fed is caught in the middle. Notably, 18 of 19 participants in the “Dot Plot” see upside risks to core PCE inflation. Also of note is the increasing dispersion of Fed funds rate forecasts among Fed members. The "dot plot" gets skinnier (more uncertainty) as the forecast period lengthens. (chart below)

The two-year Treasury yield offers a clue to bond investors thoughts on near term Fed policy. The two-year yield is falling. That means bond investors are more worried about growth than inflation at the moment.

Uncertainty is high. Economists and the public aren’t sure whether to worry about inflation, weakening economic growth, or both. Norwood Economics is fielding questions from worried clients. For instance, I had a client last week ask me my thoughts on a quote about tariffs and the price of oil. Here is the quote:

“If you’ve been watching the stock market, oil prices have also been going down because of the concern and uncertainty over the economy. So the impact of tariffs themselves may be offset if the economy does start to slow down and we see a mild recession… it’s tough to navigate the balance of, will tariffs impact prices, or will the economic slowdown basically completely offset the tariffs?"

Here was my response to the word salad above:

“Tariffs are a tax and taxes reduce economic activity. Oil is sensitive to changes in GDP growth rates. A slowing economy, all else equal, should cause oil prices to fall. However, all else is never equal. OPEC could reduce oil supply to prevent prices from falling for instance.

Economists are struggling to model how the economy will react to tariffs. Goldman Sachs has reduced its GDP growth estimate for 2025 to 1.6% from 2.4% already as I recall. A falling growth rate is likely to lead to a rising unemployment rate. A rising unemployment rate is likely to lead to faster/more Fed funds rate cuts. Monetary policy acts with a long and variable lag though. So, we will just have to see what happens going forward. I’m not changing my investment process based on guesstimates of the future though.”

Because there are too many variables interacting with one another. Humans are part of the economy and humans learn and adapt—behavior changes. No two economic cycles are alike. Attempting to predict interest rates, the unemployment rate, and economic growth is hard. Economists are wrong as often as right. Understanding the big-picture trends can help make sense of capital markets. But investors should never be too certain. Overconfidence can lead to poor results, even disastrous results.

And there are other variables at work besides tariffs. Factors that might cause unexpected trends to emerge. For instance, the recent invoking of the Alien Enemies Act. The Alien Enemies Act of 1798 is a wartime authority. It allows the President to detain or deport the natives and citizens of an enemy nation. The law permits the president to target these immigrants without a hearing. It is based only on their country of birth or citizenship.

Setting aside the fact that we are not at war. And the fact that only Congress has the Constitutional authority to declare war. In other words, staying out of the politics of the invocation of the Alien Enemies Act of 1798. Let's look at the economic consequences of mass deportation. The farming and construction industries depend heavily on undocumented immigrants. It is estimated that undocumented immigrants make up 42% of farmworkers. It's estimated that 23% of construction workers are undocumented immigrants. A wave of deportations would challenge those industries. Labor costs would rise and so would prices. More uncertainty is not what the economy and capital markets need.

Yet uncertainty may be seeping into the bones of the economy and capital markets. The slowing economy and struggling stock market are starting to raise questions. The American exceptionalism trade may be a thing of the past. “The new administration in Washington has created a very high level of generalized uncertainty that goes beyond trade policy itself,” writes Alain Bokobza, Société Générale’s head of global asset allocation. “We now wonder whether the long-awaited ‘Great Rotation’ out of U.S. assets...has begun.”

U.S. stocks are the only asset class losing money in 2025.

Regards,

Christopher R Norwood, CFA

Chief Market Strategist